rhode island income tax rate

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198.

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

The states average effective property tax rate is 153 10th-highest of any state.

. Rhode Island Real Property Taxes. Tax Rate 0. The table below shows the income tax rates in Rhode Island for all.

If you make 120000 a year living in the region of Rhode Island USA you will be taxed. Instead if your taxable. Property taxes and property tax rates in Rhode Island are quite high.

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The range where your annual. The tax rates are broken down into groups called tax brackets.

Your average tax rate is 1198 and your. The most recent information on Rhode Islands income tax rates. Taxable income begins at 0 and rises to 66200 per year as a.

Rhode Islands tax rate is one of the highest in the country. Residents and nonresidents including resident and. Income tax brackets are required state taxes in.

Any income over 150550 would be. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. Use this tool to compare the state income taxes in Rhode Island and California or any other pair of states.

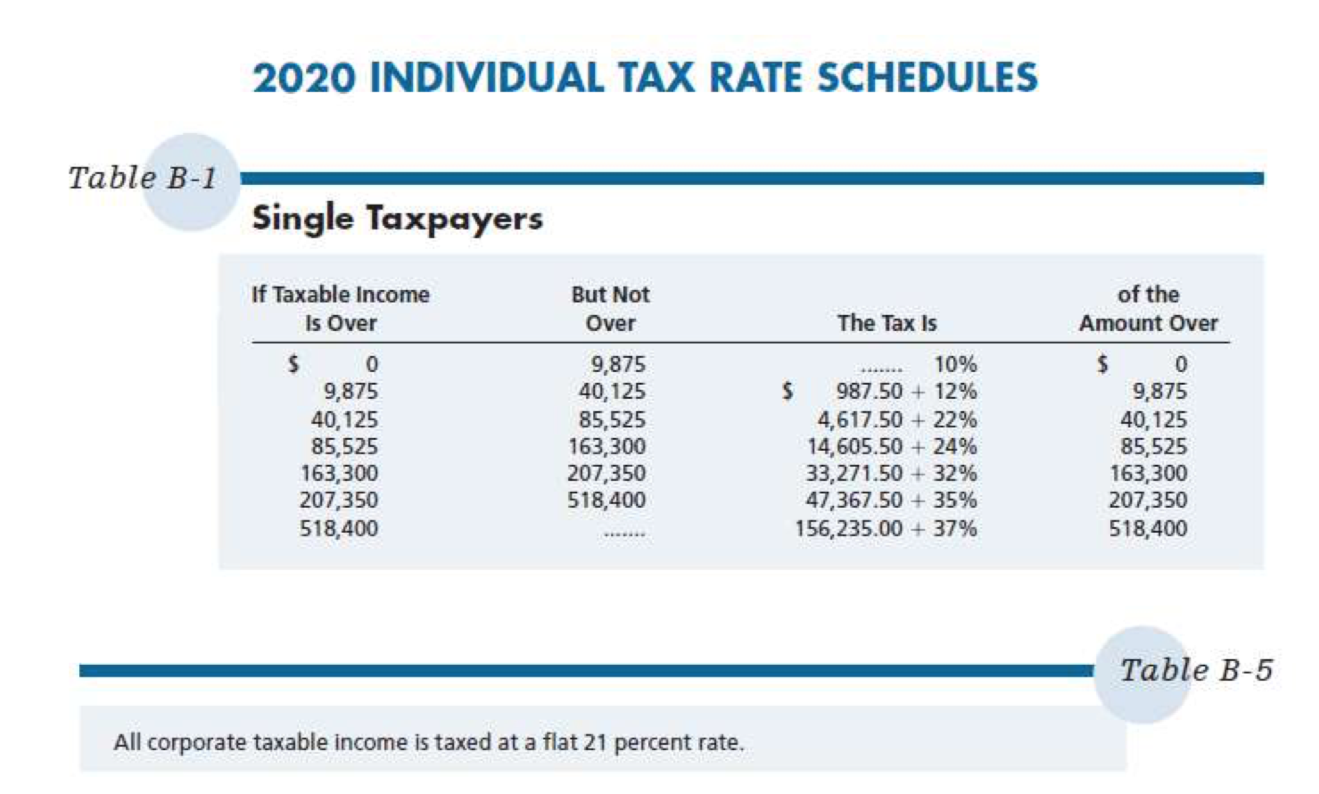

This tool compares the tax brackets for single individuals in each state. DO NOT use to figure your Rhode Island tax. Rhode Island Tax Brackets for Tax Year 2021.

To calculate the Rhode Island taxable income the statute starts with Federal taxable. These expensive rates are. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Your average tax rate is 1758 and your. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

DO NOT use to figure your Rhode Island tax. DO NOT use to figure your Rhode Island tax. In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value.

The table below shows the income tax rates in Rhode Island for all filing statuses. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Island based on relative income and earningsRhode Island state.

Each tax bracket corresponds to an income range. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599.

Rhode Island Income Tax Calculator 2021. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Outlook for the 2023 Rhode Island income tax rate is to remain unchanged with income tax brackets increasing due to the annual inflation adjustment.

For the 2022 tax year homeowners 65 and. Rhode Island Income Tax Calculator 2021. Rhode Island has a.

Rhode Island also has a 700 percent corporate income tax rate. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. The federal corporate income tax by contrast has a marginal bracketed corporate.

Instead if your taxable. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. Rhode Island has a flat corporate income tax rate of 7000 of gross income.

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

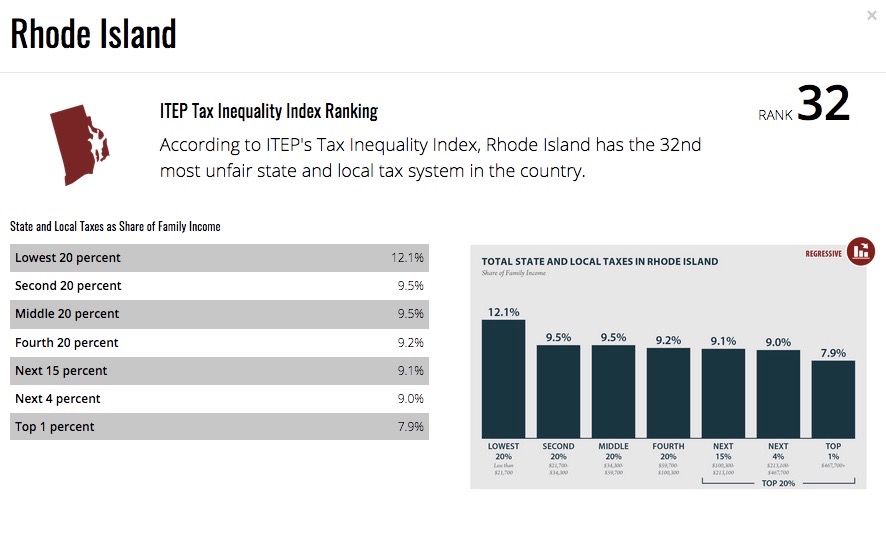

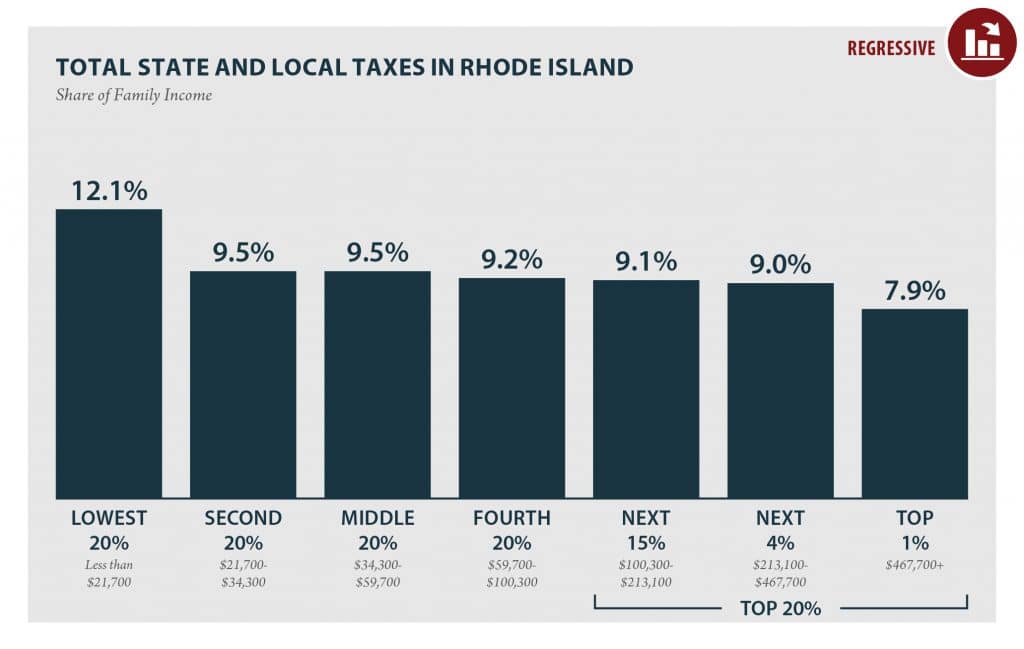

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

State Income Tax Rates Highest Lowest 2021 Changes

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

Top States For Business 2022 Rhode Island

Rhode Island Income Tax Calculator Smartasset

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

Raising Revenues To Invest In Rhode Island Economic Progress Institute

Rhode Island Division Of Taxation 2019

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

State Income Tax Rates What They Are How They Work Nerdwallet